systematic macro

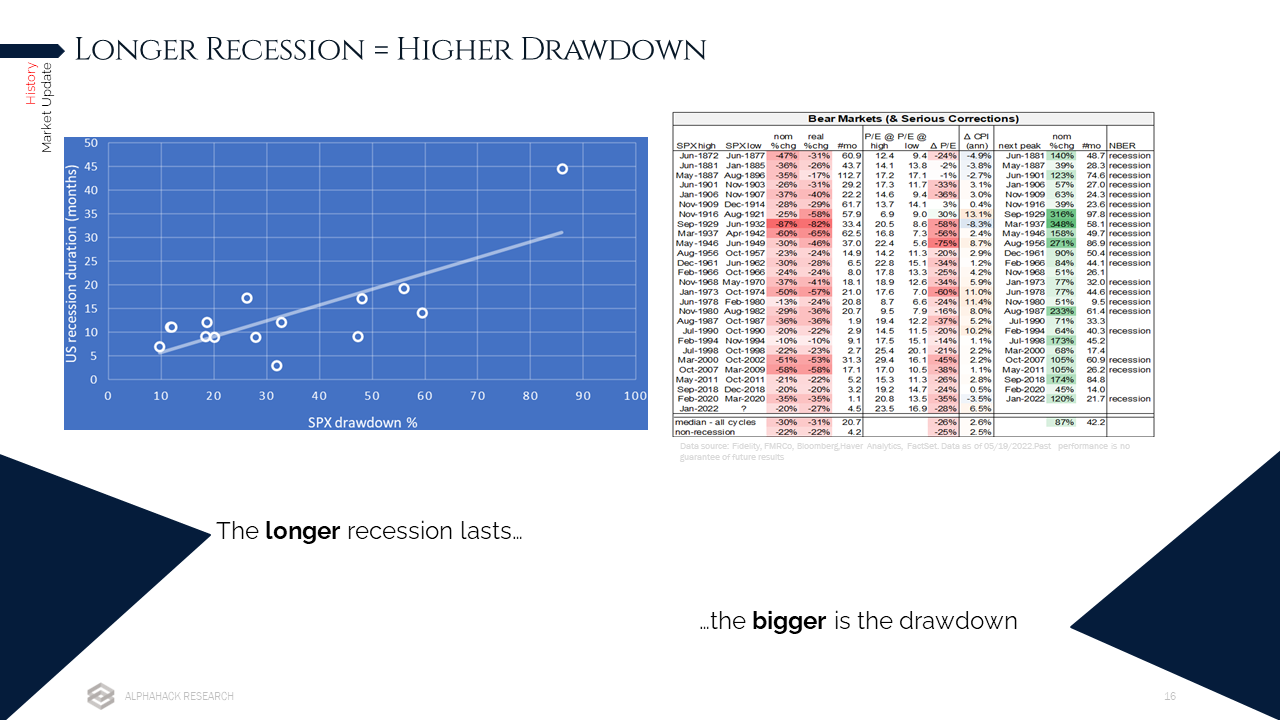

1. Bear or Bull Indicator

Giving probability based outlook on forward conditions

2. Sectors Selection

Higher conviction rate in sectors selection process

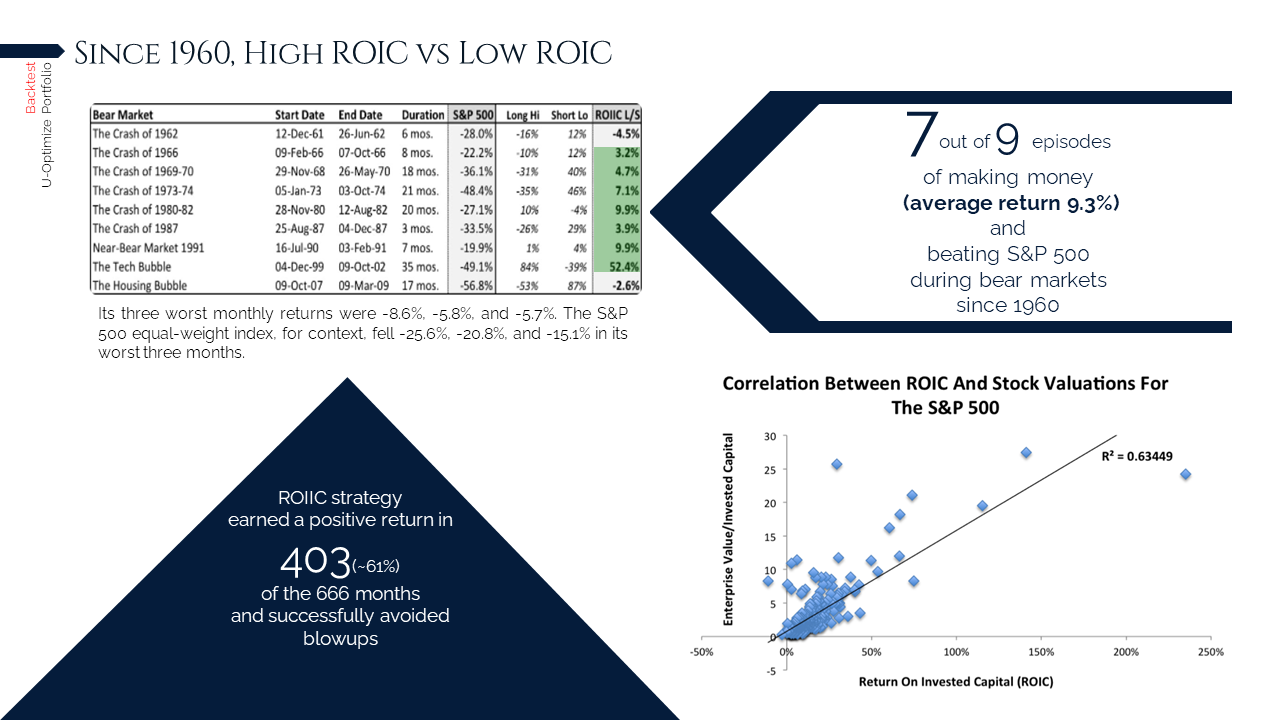

3. Factors Optimization

Optimizing factors selection on the basis of macro conditions

4. Growth and Inflation Forecasts

Tracking model nowcast forecasts of both GDP and inflation

5. Price Confirmation

Various assets relative price momentum strength assessment

6. Liquidity Assessment

Surplus/Deficit assessment of global liquidity conditions

Precise execution

Risk Bands

Have you ever wondered why the price deviates so much from your targets? We can help minimize the risk of paying too high and selling too low for any asset class.

- Systematic Trade Risk Optimization

- Better risk-reward entry points

- Sectors/Industries Screens

- Daily Updates

- Any Timeframe

- Any Region

Market Research

We cover both discretionary and systematic approaches in analysing economics, sectors and various other industries.

Contact UsRisk Optimization

Holistic approach to targeting proper

risk-adjusted returns

Defining Goals

Defining risk tolerance by having transparent goal setting

Adjusting Time Frame

Time factor plays a crucial role in risk setting

Selecting Tools

We have a wide range of subportfolios to optimize total risk/reward

MVO+ Process

Traditional mean-variance optimization process combined with macro overlay.